Five Things To Be Mindful Before Buying property in DLF One Midtown

Owning a home is everyone’s dream and for that people plan a lot from years ago. They even dream how does their home look like? Which facilities they wish in their home and how updated it should be according to them to match their standard.

Nowadays, home buyers looking for more spacious apartments for more privacy hence to provide them the best real estate developers are doing their best to cater to the occupants the best kind of living. Besides all, it is very much important that you should consider about credit score before taking such a big decision.

Because home buying is a big decision and a big purchase for a lifetime. So if you are planning to buy a home then here are five things to be mindful of before buying a home.

Home loan eligibility

Check your loan eligibility with your bank first because the loan that the banks are going to sanction to you depends on how much your take-home pay is. For instance, if your home pay is RS 30,000, it is unlikely that the bank will get a loan of worth RS 50,000.

Down payment of your home

Most of the banks give financial support up to 90 percent of your home loan, and the remaining 10% of the finances have to be managed by you. So in this case, first you check that how much loan eligibility you have to pay the down payment.

Do some inquiries which are necessary before making the decision

Before taking any decision, always inquire about the details of the property because a general investigation gives important facts about the property. Such as check that whether the building is registered with RERA or not. Banks are approving home loans or not for the property because generally, banks are giving home loans to RERA registered property. If the builder is not RERA Registered, you must not just move ahead.

Check your credit score

Now, this is the crucial part of the project. Always be ready with a good credit score while you are thinking for the property because a good credit score aid to lessen your home loan interests. Besides this, a good credit score means the chances of loan approval are easy.

Rate of interest of the home loan

While applying for a home loan you must check with your bank that if they are offering fixed interest rates or floating interest rates. Because each rate of interest has its own sets of advantages and disadvantages. Choose your option based on your condition.

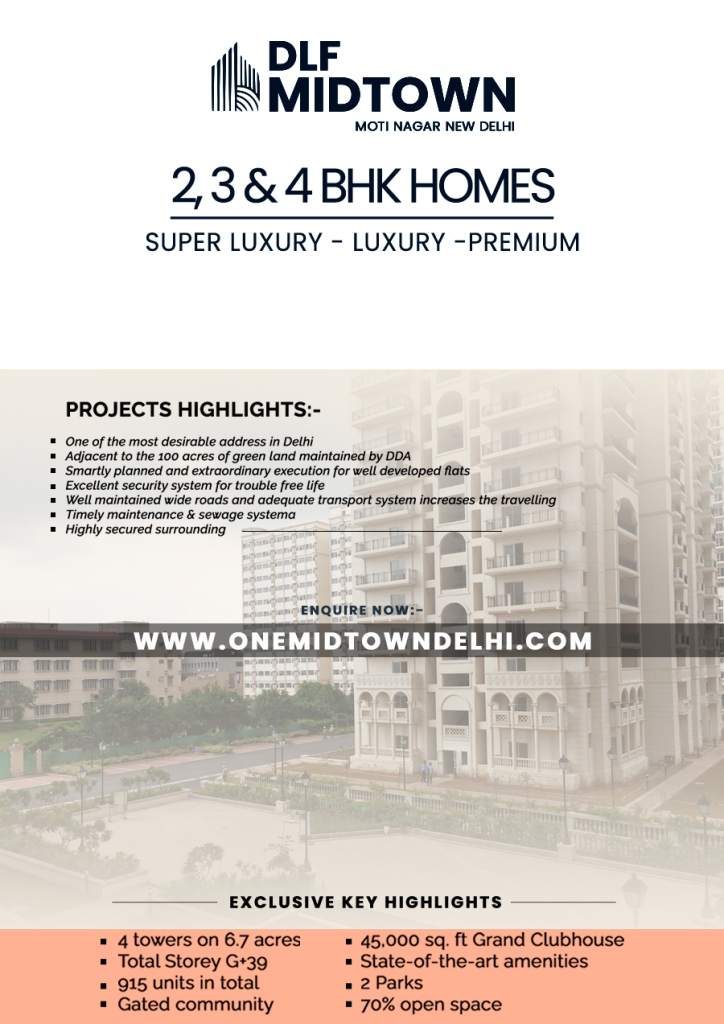

Hence if you are planning to purchase a home and your credit score is good then why don’t you think about DLF One Midtown Delhi that comes with 2, 3 and 4 BHK apartments in Moti Nagar.

Looking for premium flats at a reasonable price? DLF presents DLF One Midtown, a premium project in an ideal location in the heart of Delhi. The project is already in high demand as it is located amidst ample greenery, offers ultra-modern amenities and excellent connectivity from iconic landmarks. DLF One Midtown Moti Nagar project is surely a dream project for many looking for a convenient lifestyle.

ReplyDeleteDLF One Midtown

DLF One Midtown Moti Nagar Delhi